Publications

Letter from The CIO - December 2025

Investing with discipline: what 2025 has taught us

• November 2025: more cautious growth, driven by healthcare and telecoms, against a backdrop of volatility and mixed macroeconomic signals.

• Every year defies the prevailing narrative: the challenge is not to predict the future perfectly, but to learn lasting lessons.

• Three key lessons: nuanced monetary effects, a misleading short term, and diversification as a lasting ally.

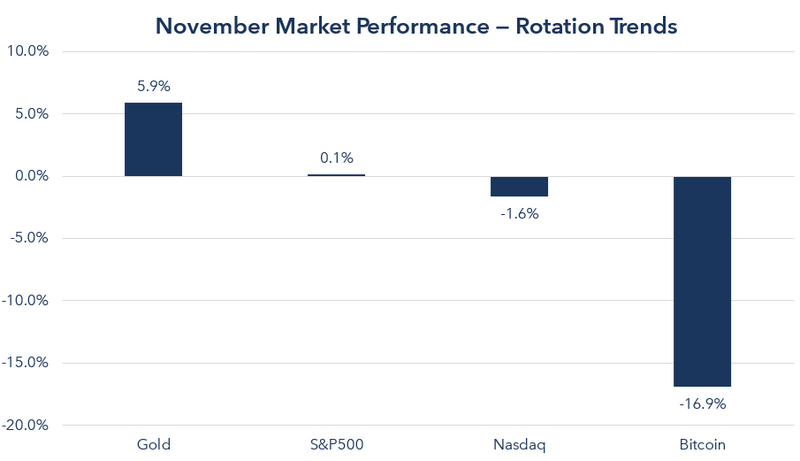

After several months of steady gains, the markets continued to rise in November, albeit at a slower pace and in a more volatile environment. Persistently high valuations in technology and artificial intelligence continue to fuel debate and questions regarding price sustainability and realistic earnings expectations. Meanwhile, shifting monetary policy expectations fluctuated with economic data releases and central bank communications, contributing to ongoing instability throughout the month. Inconsistent and sometimes contradictory economic signals across regions reinforced a sense of caution surrounding the global outlook. Despite this unsettled context, equity markets remained broadly supported, though there was a clear rotation toward more defensive sectors. Meanwhile, more speculative assets, including crypto assets, saw a significant pullback.

Source: Bloomberg / Banque Heritage

In the United States, the S&P 500 ended the month with a slight increase of 0.25%. This reflects ongoing concerns about high valuations in technology and artificial intelligence, despite a strong earnings season and growing anticipation of a Federal Reserve interest rate cut in December. Healthcare and telecommunications outperformed more cyclical segments. In the Eurozone, equities showed slightly greater resilience, supported by gains in financials, healthcare, and communication services. The EuroStoxx 600 closed the month up 1%. The Swiss market stood out with a particularly strong performance: the SMI gained 4.9%, driven primarily by the healthcare sector (Roche: +19%). Emerging markets lagged, with the MSCI EM index falling 1.4%, as investors took profits from Asian markets most exposed to technology. The Shanghai Composite declined by 1.6%. In the fixed-income market, the yield on 10-year U.S. Treasuries dropped to 4.01%. This was driven by weaker economic data and growing anticipation of a Federal Reserve interest rate cut in December. In contrast, the 10-year Bund yield in Germany increased to 2.68% (+5 bps), driven by renewed momentum in the services sector. Precious metals outperformed other commodities, with gold and silver seeing increased demand for safe-haven assets. Conversely, oil prices retreated (WTI: -4%) amid concerns over global demand. Finally, the euro strengthened slightly in the currency market, rising 0.5% against the dollar and 0.4% against the Swiss franc.

The three investment lessons that 2025 reminded us

Each year brings strong convictions, dominant scenarios, and perceived omnipresent risks. However, the evolution of data and market behavior consistently shows that economic trajectories often differ from initial predictions. As we close out the year, it is important not only to comment on the outcomes, but also to extract lasting insights from them.

Lesson 1: a restrictive monetary policy does not automatically lead to a collapse in consumption.

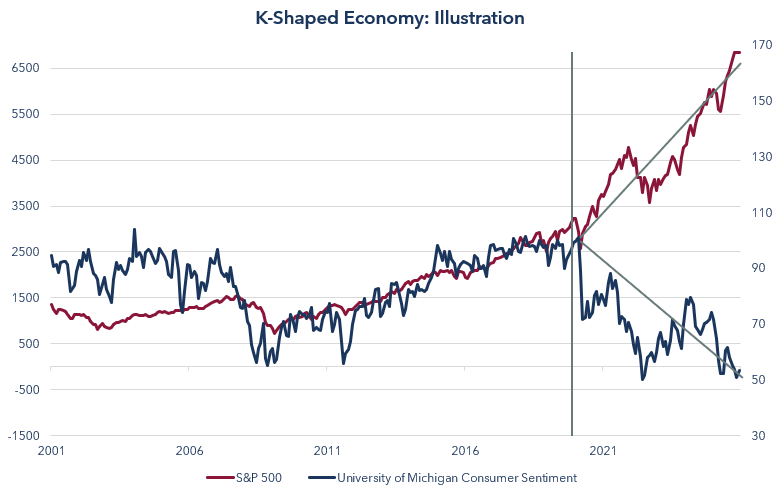

At the beginning of 2025, many anticipated that U.S. consumption would eventually decline sharply with policy rates at 4.5%, paving the way for a severe contraction in activity. However, the U.S. economy has shown surprising resilience: retail sales are growing 4.3% year-over-year (as of September, due to the shutdown), and GDPNow projects 3.5% growth in the third quarter, despite weaker household sentiment and more cautious spending intentions. This resilience can be attributed to the economy’s ability to absorb the monetary shock, including the accumulation of savings during the pandemic, a debt structure that is often fixed-rate and long-term, a robust labor market, and sectoral reallocation. In other words, the impact of a restrictive monetary policy is more gradual and varied than expected, resulting in what is now referred to as a "K-shaped economy," where some households continue to spend while others pull back.

Source: Bloomberg / Banque Heritage

The key takeaway for investors is that higher interest rates do not automatically trigger a sudden downturn. The real economy reacts with delay and nuance, far from the linear or theoretical story often conveyed by models or amplified by the media.

Lesson 2: the short term generates noise; the long term creates value

The year 2025 also reminded us that the immediate perception of events does not always align with their economic consequences. In April, the announcement and subsequent implementation of the new U.S. tariffs (“Liberation Day”) reignited fears of an inflationary shock and a risk of recession. Markets reacted instantly: the S&P 500 fell 12% in five days, while the U.S. 10-year yield surged from 3.99% to 4.59% in just six weeks. Yet, the impact observed on prices by year-end proved more contained than initially expected (current Core PCE: +2.8% year-on-year). Several factors helped soften the blow: intense negotiations between governments to limit the scope of the tariffs, supply chains that are now more diversified, increased competition among producers and distributors, substitution effects, and only a partial pass-through of cost increases to consumer prices. What appeared in the spring to be an economic cyclone is now viewed with more perspective. This does not mean the effect has been neutralized. Its impact may materialize more gradually over the coming months and should be considered within the central scenario for 2026. But the Liberation Day episode highlights a structural truth: the speed of information does not change the pace of economic cycles. Markets react instantly; the economy adjusts over time. Added to this is the human dimension, motion and cognitive bias, which can amplify initial reactions and complicate the interpretation of short-term signals.

Lesson 3: diversification remains a discipline, especially when temptation rises

During calm periods, diversification may seem unnecessary. During euphoric phases, it may seem overly cautious. However, whenever tension or uncertainty emerges, its importance becomes instantly evident. Rather than seeking to always maximize returns, diversification aims to protect, cushion, and stabilize performance over time. It is one of the few proven principles capable of absorbing shocks of unknown origin, magnitude, or timing. The past year is a clear example of this: performance drivers shift, and significant disparities persist across asset classes, regions, and investment styles. Technology stocks may have led the way for many months, but recent developments highlight renewed sector rotations, a resurgence of volatility, and new questions on the horizon. Diversification means accepting lower peaks in exchange for avoiding deeper valleys. It transforms uncertainty from a gamble into a manageable parameter. In that sense, diversification is a discipline, not merely an allocation.

As we conclude a year that reminded us that markets evolve while sound principles endure, we approach the next year with confidence and discipline. We wish you a wonderful holiday season!

December 11, 2025

Publications

Publications

Outlook 2026 H1The year 2025 confirmed a global soft-landing scenario, albeit at the cost of persistent imbalances across major economic regions.

January 15, 2026

Publications

Mirror, mirror on the wall, who is the fairest now?Powered by TikTok and rapid innovation, K-beauty is emerging as the new global force in the beauty industry.

January 12, 2026

Publications

Swiss Economic Diplomacy in TransitionMultinational companies emerge as diplomatic actors, revealing a shifting hybrid economic governance.

December 01, 2025