Publications

Letter from the CIO - February 2026

Markets in Transition: Fewer Obvious Trades, Greater Balance

- Increased volatility, but solid US data: the soft landing scenario remains intact

- Warsh at the helm of the Fed: uncertainty lifted, but monetary trajectory still unclear

- Software: after the AI euphoria, the market questions the sustainability of SaaS models

Normalisation Underway, Increasing Market Selectivity

January unfolded in a more volatile environment against a backdrop of persistent geopolitical tensions and generally solid U.S. macroeconomic data, reinforcing the soft-landing scenario. In the United States, the labour market remains resilient, with unemployment at 4.4% (Dec. 2025). While still above the Fed’s long-term target, CPI inflation edged down to 2.7%. Sector dynamics remain mixed: manufacturing continues to contract while services maintain solid momentum, pointing to still-healthy domestic demand.

In this context, the Federal Reserve held rates steady at its first meeting of the year and adopted a more confident tone regarding economic conditions with less emphasis on labour market risks and tariff pressures. Late in the month, volatility picked up in the U.S. dollar and precious metals following the announcement of Kevin Warsh’s nomination as Fed Chair, highlighting how sensitive markets remain to shifts in monetary policy signals. Early Q4 earnings releases show most companies beating both revenue and profit expectations, thus providing fundamental support to equities.

In January, global equity markets finished broadly higher. In the U.S., gains in major indices were moderate, with the S&P 500 up +1.44% and the Nasdaq +0.97%; small caps significantly outperformed (Russell 2000: +5.39%), reflecting a rotation towards more domestic and cyclical segments. Despite notable dispersion across countries, European equity performance was broadly positive, with the Euro Stoxx 50 up +2.79% and the Stoxx 600 +3.24%. Germany’s DAX ended slightly higher (+0.2%), while the UK’s FTSE 100 rose +2.99%. Swiss equities lagged modestly (SMI −0.60%). Asia and emerging markets also outperformed with the MSCI Emerging Markets index gaining +8.86% for the month supported by a weaker dollar. In fixed income, yield moves were contained: the U.S. 10-year Treasury yield rose slightly to 4.22% (+4 bps), while the German 10-year Bund held steady at 2.84%. Commodities rebounded strongly, led by energy and precious metals, with gold up +13.3%. In currency markets, the dollar continued to weaken against the euro, Swiss franc, and yen, providing support to emerging market currencies.

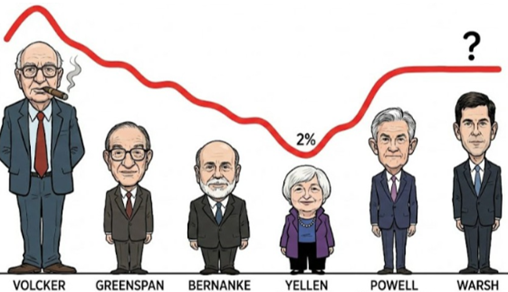

Kevin Warsh Appointed As New Fed Chair

Source: Macro Compass / Google AI

Although the announcement was widely expected, it does not materially clarify the monetary policy outlook. Kevin Warsh’s nomination as Fed Chair removes one uncertainty while introducing another. Following Janet Yellen’s tenure, Warsh was passed over during Trump’s first term in favour of Powell, a decision which Trump later said he regretted. Warsh carries a hawkish reputation that triggered a reflex market reaction: gold down, dollar up, equities under pressure. That label largely stems from his long-standing criticism of post-crisis quantitative easing which he views as excessive, distortionary for asset prices, and a source of longer-term financial risks. He has also tended to favour a more pre-emptive Fed stance against inflation and greater attention to the side effects of overly accommodative policy on financial stability.

That said, a strict hawkish interpretation deserves nuance today. His more recent remarks appear more pragmatic than ideological, emphasising productivity, supply-side dynamics, and real economic capacity as factors that can contain inflation and therefore justify easier policy if data allow. It also seems unlikely that Trump would appoint a Fed Chair fundamentally opposed to his preference for lower rates. We now have a name, but not yet a clearly defined reaction function. Markets continue to price in two rate cuts this year. In an environment of elevated long-end rate volatility, we maintain a tactical preference for short-to-medium duration where macro and policy visibility is stronger.

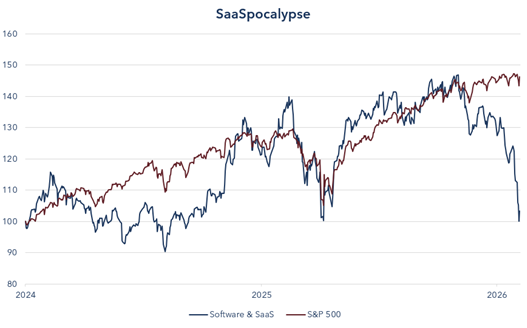

SaaS-pocalypse: From FOMO To FOBO

Since the start of the year, the correction in technology stocks, particularly software companies, reflects a shift in how AI-related risk is being priced: the market has moved from fear of missing out (FOMO) to fear of becoming obsolete (FOBO). In 2024, enthusiasm around generative AI strongly supported valuations: any company adding AI-driven features, automation layers, or assistant tools benefited from an immediate premium. With the rapid rise of agentic AI, systems that not only generate answers but also execute actions, coordinate tasks, and run workflows, investors are reassessing the durability of many SaaS business models. Software solutions built primarily as thin interface or automation layers appear increasingly exposed to direct substitution by intelligent agents. Markets are therefore pricing higher risks of commoditisation, rising competition, and margin pressure across lighter SaaS models, explaining the relative underperformance of software versus tech infrastructure and semiconductors.

Against this backdrop, we maintain a disciplined and balanced approach within equity portfolios. AI-related investment remains a powerful long-term driver, but uncertainty around monetisation speed and delivery versus expectations calls for greater selectivity among richly valued growth names. At the same time, the ongoing rotation is creating attractive entry points in cyclical and value segments that have long been overlooked. In this more fragmented market phase, sector diversification and style balance, across growth/value, quality, and cyclicals, remain in our view the most effective way to navigate volatility and capture multiple sources of return.

Source: Bloomberg / Banque Heritage

February 12, 2026

Publications

Publications

Outlook 2026 H1The year 2025 confirmed a global soft-landing scenario, albeit at the cost of persistent imbalances across major economic regions.

January 15, 2026

Publications

Mirror, mirror on the wall, who is the fairest now?Powered by TikTok and rapid innovation, K-beauty is emerging as the new global force in the beauty industry.

January 12, 2026

Publications

Letter from The CIO - December 2025Investing with discipline: what 2025 has taught us

December 11, 2025