Publications

Outlook 2026 H1

The year 2025 confirmed a global soft-landing scenario, albeit at the cost of persistent imbalances across major economic regions.

👉 Download the PDF version here.

INTRODUCTION

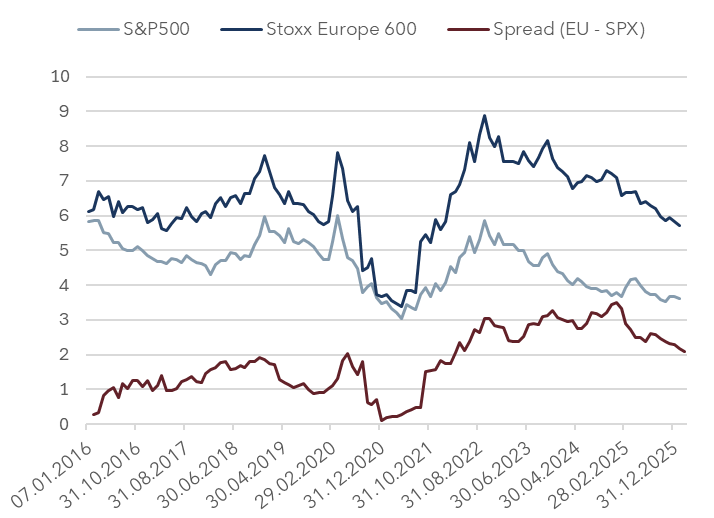

The U.S. economy once again demonstrated its resilience and relative outperformance, China slowed without a systemic rupture while Europe remained the weak link, constrained by structural fragilities. Central banks accompanied this normalization phase: the European Central Bank (ECB) is approaching the end of its easing cycle while the U.S. Federal Reserve (Fed) is adjusting its trajectory in a gradual and strictly data-dependent manner. Financial markets have priced in this resilience, perhaps with a degree of complacency. Equity valuations remain elevated, particularly in the United States, where performance continues to be highly concentrated in a limited number of large technology stocks. By contrast, certain regions and segments, most notably European and emerging markets, retain a more attractive relative profile.

As 2026 begins, geopolitics represents one of the main risk factors. U.S. intervention in Venezuela and the explicit return of a Monroe-style doctrine confirms the end of multilateralism and the emergence of a more transactional, fragmented, and unpredictable world where power dynamics increasingly prevail over shared rules. This shift durably increases uncertainty and could extend to other areas of tension, particularly in Asia, amid growing strategic rivalry between the United States and China.

Monetary policy will remain another key area of vigilance. Diverging paths between the Fed and the ECB will continue to shape markets, and any policy misjudgment could reignite volatility. Finally, 2026 is shaping up to be a year of truth for technology stocks: after representing the bulk of U.S. equity market performance in 2025, elevated valuations and leverage leave little room for execution risk. In this more demanding environment, our approach for the first half of 2026 is built on clear convictions, strict discipline, and active risk management.

UNITED STATES

We remain constructive on the United States while maintaining an allocation close to our neutral level in an environment where macroeconomic fundamentals remain solid, but valuation levels and certain structural imbalances warrant increased vigilance. The U.S. economy is expected to grow at a pace close to its potential in 2026, allowing us to rule out a recessionary scenario at this stage. Supported by strong domestic demand, robust investment dynamics, and an institutional and regulatory framework conducive to innovation, it should continue to outperform other major developed economies, particularly Europe. This structural strength reinforces our strategic preference for the United States within international allocations. Inflation is expected to continue its gradual moderation while settling structurally above the levels observed during the post-global financial crisis decade.

This new regime reflects the progressive normalization of supply chains, easing cost pressures, a less tight labor market, as well as a monetary policy that has become gradually more accommodative. Productivity gains, driven by the increasing adoption of artificial intelligence, also represent a structural growth driver and a key transformation factor for the U.S. economy.

In this context, Federal Reserve policy should remain accommodative, while staying strictly data-dependent. Our central scenario assumes a terminal policy rate close to 3%. While the central bank’s communication is likely to become gradually more dovish, particularly following the replacement of Jerome Powell, interest rates are expected to remain structurally higher than in the previous decade, reflecting a lasting shift in the macro-financial regime.

The labor market remains a key variable for monetary policy. A slowdown is expected, but more in the form of normalization than an abrupt break. In this framework and given the growing impact of productivity gains, weakening employment dynamics should no longer be interpreted mechanically as a signal of economic slowdown. Finally, fiscal policy is expected to remain expansionary, supporting short-term growth through consumption and investment. Deficits are likely to remain elevated, and industrial support programs should continue, notably in artificial intelligence, energy, defense, and industrial reshoring. These policies nevertheless increase long-term risks, particularly in fixed income markets, through higher refinancing costs and a potentially higher term premium. The United States therefore remains the region offering the strongest structural growth potential, but also the one where risks are most concentrated, thus justifying a disciplined, diversified, and selective investment approach.

EUROPE

European growth is expected to remain moderate but positive in 2026 and to continue lagging that of the United States. The region’s potential remains structurally constrained by an economic fabric still largely oriented toward traditional industry and highly regulated services. These sectors benefit only marginally from productivity gains linked to artificial intelligence, at least not to the same extent as observed across the Atlantic. In this context, the state plays a central role in supporting economic activity. Large-scale public investment, notably in infrastructure, energy transition, and defense partially offsets underinvestment by the private sector. This stimulus helps stabilize growth without generating a genuine acceleration, while raising medium-term questions regarding the sustainability of public finances. The macroeconomic outlook nevertheless appears relatively balanced: the risk of a major negative surprise remains limited, and no recession is anticipated at this stage even though the European economy remains highly dependent on developments in the U.S. and Chinese economic cycles.

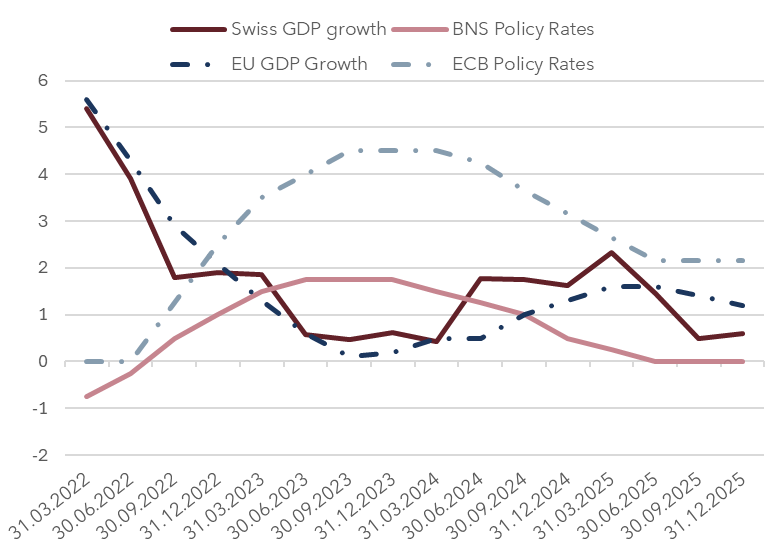

On the inflation front, disinflation is now well underway, and inflation should converge toward the ECB’s target over the coming quarters. Inflation risks appear more contained than in the United States, allowing European monetary policy to remain more accommodative and more predictable over the medium term. In this environment, European equities offer attractive relative valuations and yields. However, given limited growth potential, Europe does not represent a beta call but rather a more defensive positioning. We therefore favor a neutral exposure, built around carefully selected sectors and companies.

SWITZERLAND

Despite a complex macroeconomic situation that remains highly correlated with European and U.S. cycles, Switzerland continues to serve as an anchor of stability and a safe haven in an uncertain global environment. Growth is expected to slightly exceed 1% in 2026, supported by a gradual European recovery and U.S. resilience, but constrained by a structurally strong Swiss franc and the persistence of high tariffs which continue to weigh on export-oriented sectors.

Inflation should remain low, around 1%, with deflationary risks still present, justifying the maintenance of an accommodative monetary policy with policy rates at 0%. The Swiss National Bank does not appear inclined to return durably to negative rates, although this scenario cannot be entirely ruled out in the event of an external shock. In this uncertain geopolitical and economic environment, the Swiss franc is likely to remain in demand as a safe haven, limiting the scope for a cyclical recovery in the domestic economy. In financial markets, Swiss equities remain attractive from a valuation perspective, while the bond market offers limited returns. The defensive structure of the equity market gives Switzerland a meaningful stabilizing role within portfolios, oriented more toward capital preservation than cyclical performance.

EMERGING MARKETS

Emerging markets represent a credible alternative for capturing flows outside U.S. markets. Their macroeconomic environment is broadly supportive, driven by a monetary cycle that is more advanced than in developed economies. Many emerging market central banks have already begun cutting rates, supporting domestic activity. In this context, growth in emerging economies is expected to remain well above that of developed countries, at around 4% in 2026 according to the International Monetary Fund (IMF), with Asia as the main contributor. Several tailwinds support this scenario. Industrial reshoring and the reconfiguration of global value chains are fostering investment in key regions, while the rise of domestic consumption is gradually reducing reliance on exports. In addition, a less dominant U.S. dollar improves financial conditions and supports flows into emerging market assets.

China remains a central driver of the emerging universe, despite a still challenging environment marked by slowing growth, persistent deflationary pressures, and a strong dependence on public support. Its economic weight nevertheless remains decisive, alongside a very dynamic South Asia where growth is expected to exceed 6% in 2026. In this context, and in continuity with 2025, we remain constructive on emerging markets. However, this positioning should be viewed as a cyclical rather than defensive bias, requiring a selective and diversified approach in an uncertain global environment.

ASSET ALLOCATION

The resilience of the U.S. economy, the absence of a recession in major developed economies, and the strong growth potential of emerging markets continue to support financial markets. However, this normalization is taking place against a backdrop of elevated valuations, highly concentrated performance, and heightened exogenous risks, particularly on the geopolitical and monetary fronts. The gradual end of easing cycles, persistent divergences among central banks, and the emergence of a more fragmented global order are increasing uncertainty and the likelihood of renewed volatility episodes. In this context, portfolio construction can no longer rely solely on directional risk exposure but must instead be based on a disciplined, selective, and diversified allocation, favoring asset quality, cash-flow visibility, and diversification benefits.

EQUITY

For the first half of the year, we maintain a constructive but cautious stance, keeping overall equity exposure close to neutral in an environment marked by the end of monetary normalization cycles and elevated geopolitical uncertainty. Our positioning is based on a cyclical and differentiated view of growth, with a preference for the United States and emerging markets, offset by a more defensive allocation in Europe.

Our equity outlook is highly selective and disciplined, aiming to benefit from the persistent divergence between U.S. and European economic cycles while capitalizing on three long-term cross-thematic drivers which are structurally reshaping investment flows: artificial intelligence, defense, and the energy transition. Within this framework, we favor industrial and infrastructure sectors the dynamics of which differ significantly across regions.

In the United States, rising geopolitical tensions, supply-chain reshoring, and sovereignty considerations continue to support defense-related investments. At the same time, the rapid expansion of AI is generating sustained demand for critical physical infrastructure, notably power grids, electricity capacity, and related equipment.

In Europe, the acceleration of public spending, particularly in Germany, across defense and green infrastructure, combined with easing energy costs, creates a more supportive backdrop for a gradual albeit still uneven industrial recovery.

Utilities also represent a core pillar of our allocation, increasingly acting as a proxy for technological growth. In the U.S., surging electricity demand from AI-driven data centers enhances cash-flow visibility and business-model resilience. In Europe, we favor players exposed to grid modernization and green infrastructure.

Finally, within financials, we prefer large, diversified U.S. banks, which stand to benefit from a deregulation-friendly environment and strong balance sheets. In Europe, bank profitability remains supported by yield-curve steepening, translating into attractive dividend and share buyback policies.

FIXED INCOME

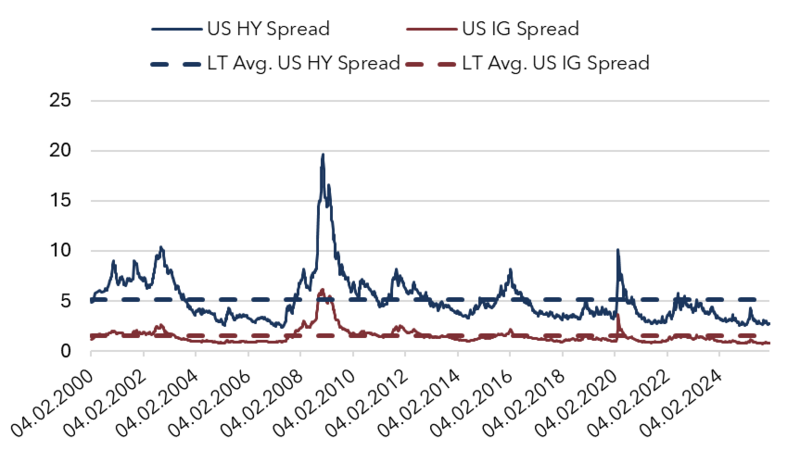

The macroeconomic environment remains constructive, supported by resilient growth and an expected rebound in the second half of the year. Inflation appears largely under control, and monetary policies are approaching the end of their easing cycles, providing good short- and medium-term visibility. Risks related to fiscal deficits in the United States and Europe persist but are expected to remain manageable over these horizons. Within sovereign bonds, we favor short to intermediate maturities on both U.S. and European curves. Long-duration exposure is avoided due to limited visibility on long-term growth and heightened sensitivity to public debt dynamics. Our stance on Investment Grade credit remains cautious, as current spread levels offer limited compensation for credit risk. We therefore favor short to medium durations which provide the best balance between carry and risk control.

The resilience of economic activity supports a neutral stance on High Yield. While risk premia remain more attractive than in Investment Grade, selectivity is essential, with a focus on high-quality issuers, low leverage, and predictable cash flows. Convertible bonds are overweighted, given their attractive asymmetric profile, combining downside protection, limited interest-rate sensitivity, and upside participation in equity markets in a more volatile environment.

Emerging market debt, particularly in local currency, is also a key allocation theme. Local EM bonds offer higher real yields than developed markets, providing solid risk compensation and a meaningful income buffer. A weaker U.S. dollar and more advanced economic cycles in these countries should continue to act as supportive tailwinds. Finally, we maintain exposure to catastrophe bonds, which offer attractive diversification, higher yields than traditional credit, and relatively low volatility.

COMMODITIES

Gold remains a key strategic allocation within our portfolios, despite the strong rise in gold prices observed in 2025. It continues to fully play its role as a safe haven, a hedge against rising public deficits, and a protection against risks of declining central bank credibility in an environment of persistent pressure on the U.S. dollar. This conviction is reinforced by robust structural demand, driven by emerging market central banks, investor flows through ETFs, and a medium-term outlook for fragile real interest rates.

In contrast, we remain structurally underweight energy. Global growth continues to stabilize while supply remains broadly in excess of demand. Over the medium term, uncertainty surrounding Venezuelan reserves and their potential return to the market could further exacerbate supply-demand imbalances, putting additional downward pressure on oil prices. In this context, we maintain a cautious stance on crude oil in the absence of a clear catalyst capable of sustainably supporting prices.

CURRENCIES

Our currency outlook remains cautious and diversification oriented. The U.S. dollar remains under pressure amid expected continuing Federal Reserve rate cuts in the first half of the year, deteriorating public finances, heightened political risks, and growing questions around central bank independence. These factors fuel the risk of gradual de-dollarization of global reserves and limit the dollar’s appreciation potential over the medium term. In contrast, the euro could benefit from Europe’s cyclical recovery, supported by German fiscal stimulus and the stabilization of ECB monetary policy. The Swiss franc is expected to remain strong, underpinned by its safe-haven status, persistently low inflation, and the prudent stance of the Swiss National Bank. In this environment, we favor greater currency diversification in order to reduce dependence on the U.S. dollar and to enhance portfolio resilience in a world characterized by persistent fiscal imbalances and the increasing fragmentation of the international monetary system.

January 15, 2026

Publications

Publications

Affordability, America’s Achilles’ HeelIn an economy that remains wealthy yet increasingly fragmented, purchasing power has become Washington’s primary test.

February 13, 2026

Publications

Letter from the CIO - February 2026Markets in Transition: Fewer Obvious Trades, Greater Balance

February 12, 2026

Publications

Mirror, mirror on the wall, who is the fairest now?Powered by TikTok and rapid innovation, K-beauty is emerging as the new global force in the beauty industry.

January 12, 2026